maine tax rates for retirees

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Download a sample explanation Form 1099-R and the.

Pros And Cons Of Retiring In Maine Cumberland Crossing

Maines tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

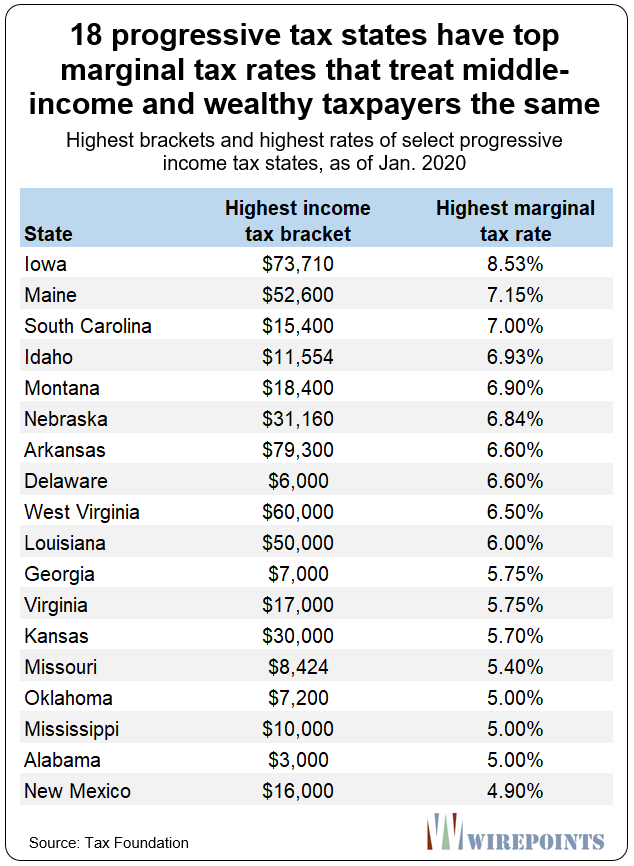

. Maine has three marginal tax brackets ranging from 58 the lowest maine tax bracket to 715 the highest maine tax bracket. Your 2021 Tax Bracket to See Whats Been Adjusted. Some states with low or no income taxes have.

The states top rate still ranks as one of the. For example the highest marginal income-tax rates in Arizona Kansas New Mexico and. Minimum Tax Credit Worksheet PDF Maine Minimum Tax Credit and Carryforward Worksheet for Form 1040ME Schedule A line 17.

12 States That Wont Tax Your Retirement Distributions. Maine tax rates for retirees Friday August 12 2022 Edit Residents also pay income taxes at a rate of 65 on income between 5200 and 20899 and 795 on income of 20900 or more. The tax rates range from 58 on the low end to 715 on the high end.

The 20 tax rate applies only to single taxpayers with incomes above 445850 or 501600 for married taxpayers. A married couple with 50000 in taxable income could. Residents also pay income.

The effective state and local tax rate is 1181 which is 933 higher than the national average. Maines median income is 55130 per year so the median yearly property tax paid by Maine residents amounts to approximately of their yearly income. For tax year 2022 employers or non-payroll filers who reported Maine income tax withholding of 18000 or more for the 12 months ending June 30 2021 are required to make payments of.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. With all that in mind here are the top 10 best places to retire in Maine. However Maines sales tax rate is considerably low at 55.

Some states with low or no income taxes have higher property or. Maine is ranked 17th of the 50. Consider also states that have a relatively low income-tax rate across all income levels.

The rates ranged from 0 to 795 for tax years beginning after. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Maine Income Taxes The state income tax in Maine is based on just three brackets.

Although the state does not tax Social. Kennebunk is a seaside town with a tax burden of 1570 which is the tax rate of. Maine is also on the more expensive side with taxes.

Maine Sales Tax Calculator And Local Rates 2021 Wise

States That Won T Tax Your Federal Retirement Income Government Executive

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation

Tax Withholding For Pensions And Social Security Sensible Money

Learn More About The Massachusetts State Tax Rate H R Block

Maine State Tax Refund Tax Brackets State Tax Deductions

States With The Highest Lowest Tax Rates

Property Taxes Urban Institute

![]()

Report Millionaires Didn T Flee When Tax Rates Increased In Certain States Maine Beacon

15 States That Don T Tax Retirement Income Pensions Social Security

Progressive Tax Hike Proposal Attacks Illinois Working And Middle Classes

Maine Among Priciest States To Retire Study Says Mainebiz Biz

10 Most Tax Friendly States For Retirees Kiplinger

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

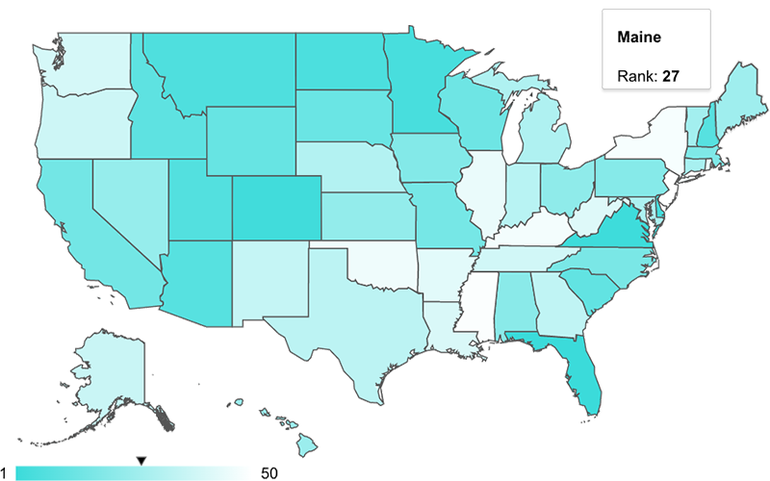

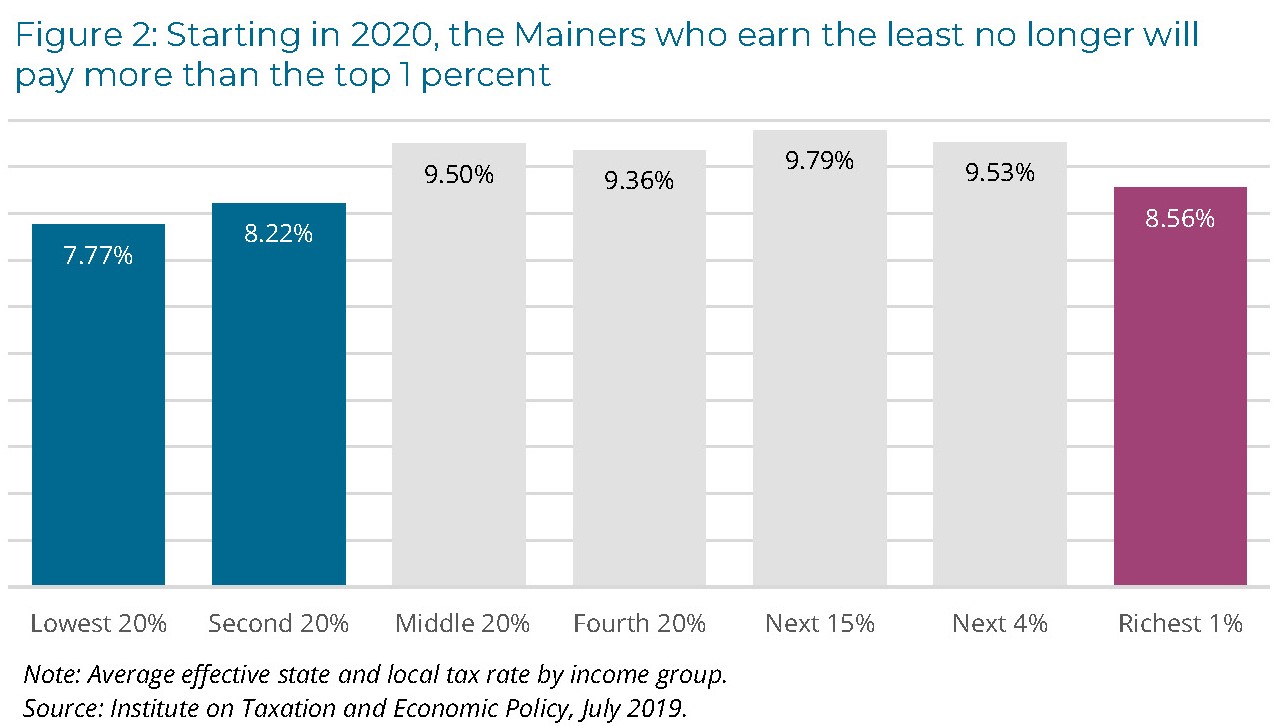

Maine Reaches Tax Fairness Milestone Itep

/cloudfront-us-east-1.images.arcpublishing.com/gray/7VBG2QD4JFEKFGJ5C2DAV6H4LQ.JPG)

Maine S Property Tax Stabilization For Senior Citizens Law Takes Effect

Property Taxes Urban Institute

![]()

Opinion A Recent History Of Maine S Swiftly Evolving Tax Code Maine Beacon